IRS 4684 2015 free printable template

Show details

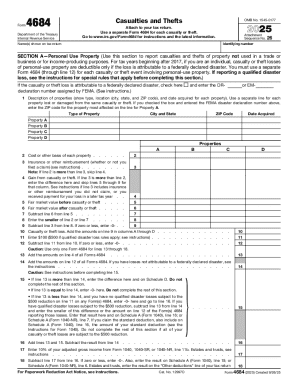

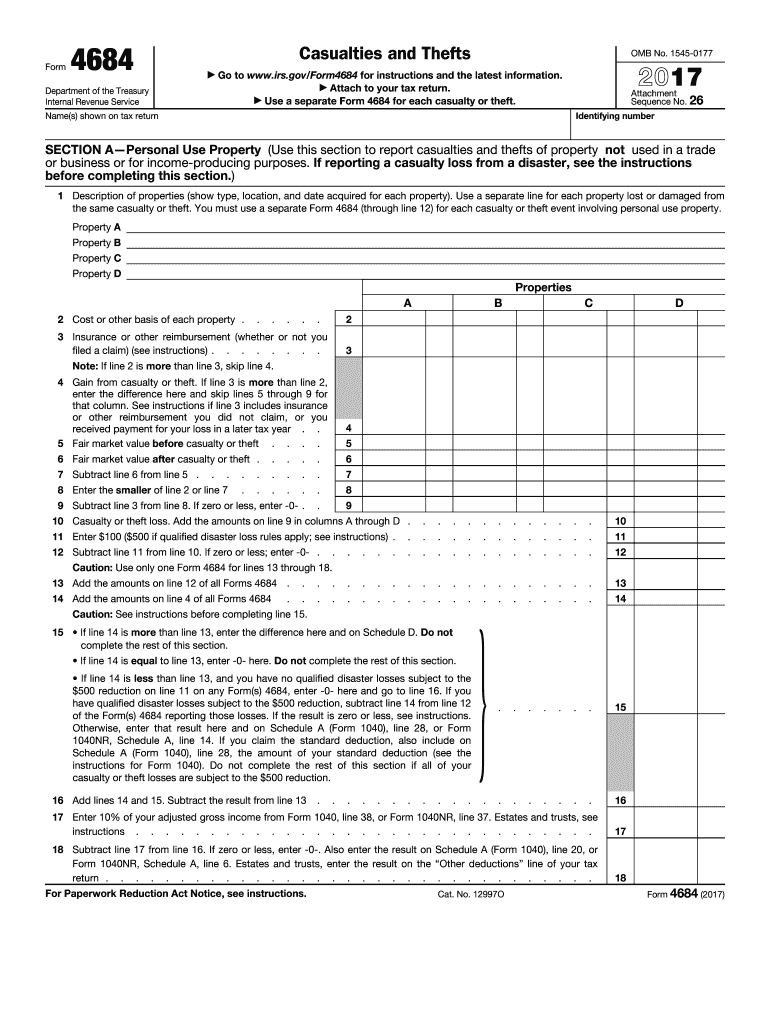

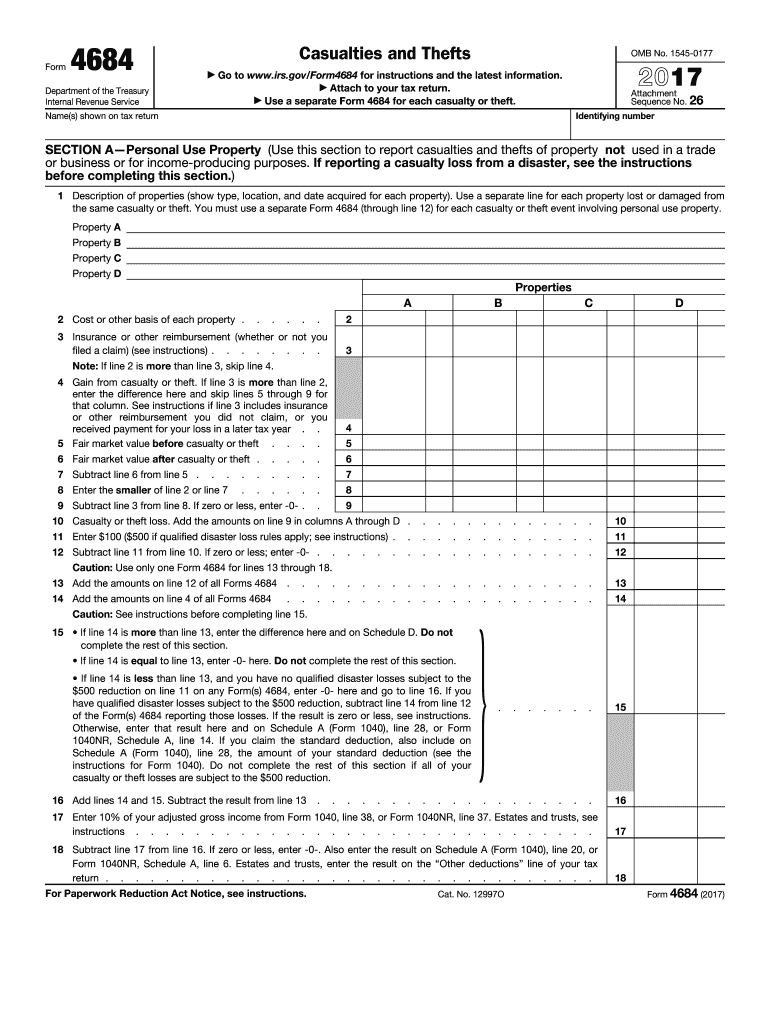

Form4684Department of the Treasury

Internal Revenue ServiceCasualties and Thefts

OMB No. 154501772017Go to www.irs.gov/Form4684 for instructions and the latest information.

Attach to your tax return.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 4684

Edit your IRS 4684 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 4684 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 4684 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 4684. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 4684 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 4684

How to fill out IRS 4684

01

Obtain Form 4684 from the IRS website or your tax preparer.

02

Fill out your personal information at the top of the form, including your name and Social Security number.

03

Determine the type of casualty or theft loss you are reporting and select the appropriate section of the form.

04

List the details of the property affected, including the type, date of event, and location.

05

Calculate the amount of your loss using the guidelines provided in the instructions for the form.

06

Provide any required supporting documentation as outlined in the form instructions.

07

Complete any additional sections of the form as necessary, based on your situation.

08

Review your filled form for accuracy before submitting it with your tax return.

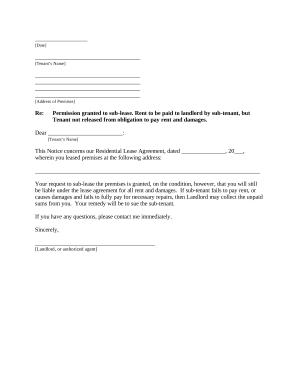

Who needs IRS 4684?

01

Individuals who have experienced a casualty loss due to events such as natural disasters or theft.

02

Taxpayers who need to report losses in property that are not covered by insurance.

03

Those seeking to claim a deduction for losses on their federal tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is a 4684 tax form?

Attach Form 4684 to your tax return to report gains and losses from casualties and thefts.

When can you claim casualty losses?

You may be eligible to claim a casualty deduction for your property loss if you suffer property damage during the tax year as a result of a sudden, unexpected or unusual event.

What is an example of a casualty and or theft loss?

Storms, including hurricanes and tornadoes. Terrorist attacks. Vandalism. Volcanic eruptions4

What is considered a theft loss for tax purposes?

Casualty and theft losses are deductible losses that arise from the destruction or loss of a taxpayer's personal property. To be deductible, casualty losses must result from a sudden and unforeseen event. Theft losses generally require proof that the property was actually stolen and not just lost or missing.

How is net deductible casualty loss calculated?

Calculating the Casualty Loss Deduction If you are claiming a deduction based on property that was destroyed, you will need to calculate the casualty loss by subtracting the salvage value from the adjusted basis of the asset and then subtracting any insurance proceeds from the result.

How do you prove casualty loss?

You will need proof a casualty caused your loss. So, keep newspaper accounts and other proof showing the type of casualty that struck your area and the amount of damage it did. To prove the amount of your loss, you should have: Purchase receipts for the affected property.

How do you calculate disaster loss?

To determine your allowable loss, deduct insurance proceeds or other reimbursement you received or expect to receive. Next, subtract $100 and then 10% of your federal adjusted gross income. Claim the remaining amount as your casualty or disaster loss.

Are personal casualty losses deductible in 2022?

Losses You Can Deduct For tax years 2018 through 2025, if you are an individual, losses of personal-use property from fire, storm, shipwreck, or other casualty, or theft are deductible only if the loss is attributable to a federally declared disaster (federal casualty loss).

What are qualified disaster distributions?

When an event is declared a disaster by the president, the IRS will postpone some retirement plan and IRA deadlines for taxpayers in affected areas. These disasters are usually hurricanes, tornados, flooding, earthquakes, and wildfires.

What is a qualified disaster for Form 4684?

A disaster loss is a loss that occurred in an area determined by the President of the United States to warrant federal disaster assistance and that is attributable to a federally declared disaster. It includes a major disaster or emergency declaration. -2- Instructions for Form 4684 (2021)

What qualifies as a casualty loss?

A casualty loss can result from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event such as a flood, hurricane, tornado, fire, earthquake, or volcanic eruption. A casualty doesn't include normal wear and tear or progressive deterioration.

What is casualty and/or theft loss?

What is casualty and theft loss? A casualty and theft loss is one caused by a hurricane, earthquake, fire, flood, theft or similar event that is sudden, unexpected or unusual. You can deduct a portion of personal casualty or theft losses as an itemized deduction.

Do I need to file Form 4684?

In most cases, this form only applies to personal losses, not for casualties and thefts related to the business property. Once you have determined that your casualties or thefts qualify for a deduction, complete Form 4684 and either attach it to your return or to an amended return for a past claim.

What qualifies for a casualty loss deduction?

Casualty Losses A casualty loss can result from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event such as a flood, hurricane, tornado, fire, earthquake, or volcanic eruption. A casualty doesn't include normal wear and tear or progressive deterioration.

How do I claim disaster loss on my taxes?

Claiming the Loss Individuals may claim their casualty and theft losses as an itemized deduction on Schedule A (Form 1040), Itemized Deductions (or Schedule A (Form 1040-NR)PDF, if you're a nonresident alien).

What is an example of a casualty and or theft loss?

In fact, as mentioned above, IRS Publication 547 establishes that casualty and theft losses “are deductible only to the extent they're attributable to a federally declared disaster.” Some examples include: Floods. Government-ordered demolition or relocation of a home that is unsafe to use because of a disaster.

What is a net qualified disaster loss?

A qualified disaster loss is similar to a casualty loss but may provide more favorable tax deductions. Not every federally declared disaster is known as a qualified declared disaster. Examples of declared disasters that were qualified include Hurricane Harvey, Hurricane Irma, and the California wildfires.

What does the IRS consider a qualified disaster?

A disaster loss is a loss that is attributable to a federally declared disaster and that occurs in an area eligible for assis- tance pursuant to the Presidential declaration. The disaster loss must occur in a county eligible for public or individual assistance (or both).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS 4684 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your IRS 4684, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the IRS 4684 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit IRS 4684 on an iOS device?

Create, edit, and share IRS 4684 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is IRS 4684?

IRS Form 4684 is used to report casualties and losses, specifically for the purposes of claiming a deduction for property that has been damaged or lost due to events such as theft, natural disasters, and other qualifying incidents.

Who is required to file IRS 4684?

Taxpayers who have suffered losses from casualties or theft and wish to claim a deduction on their tax return are required to file IRS Form 4684.

How to fill out IRS 4684?

To fill out IRS Form 4684, taxpayers must provide detailed information about the nature of the loss, the date it occurred, the fair market value before and after the event, and any insurance reimbursements received. The form's instructions guide users through each section.

What is the purpose of IRS 4684?

The purpose of IRS Form 4684 is to allow taxpayers to report specific losses to the IRS, which can help reduce their taxable income by claiming deductions for qualifying casualty and theft losses.

What information must be reported on IRS 4684?

IRS Form 4684 requires taxpayers to report information such as the date of the loss, a description of the property, its cost basis, its fair market value before and after the loss, and any insurance or other reimbursements.

Fill out your IRS 4684 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 4684 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.